montgomery county maryland earned income tax credit

The credit is equal to 50 of the federal tax credit. This County program grants a credit against the county real property tax in order to offset in whole or in part increases in the county income tax revenues resulting from a county income.

Council Expands Eligibility For County S Local Income Tax Credit Montgomery Community Media

Income limits vary depending on your filing status AGI and the.

. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the. It is important to. If you earned less than 60000 in 2022 you may qualify for the federal Maryland and Montgomery Earned Income Tax Credit.

A taxpayer must apply for the tax credit with the Montgomery County Division of Treasury by April 1 to receive the credit in the next taxable year. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. If you qualify for the federal earned.

Questions regarding eligibility for either the State or Montgomery County EIC must be addressed to the State of Maryland Office of the Comptroller at. By Online Ticket By phone. You may be eligible to claim an earned income tax credit on your 2021 federal and state tax returns if both your federal adjusted gross income and your earned.

What is the Earned Income Credit. If you file with. Previous law required that in order to claim the WFIS tax credit a resident must be eligible and qualify for both the federal and state earned income tax credit.

The program is administered by the Internal. The maximum federal EITC is 6728. Earned Income Tax Credit EITC.

Residents of Montgomery County pay a flat county income tax of 320 on earned income in addition to the Maryland income tax and the Federal income tax. The Montgomery County Council passed Bill 48-16 which clarifies that the Income Tax Offset Tax Credit or ITOC this credit is labeled County Property Tax Credit on the property tax bill may. Montgomery County Division of Treasury 27 Courthouse Square Suite 200 Rockville MD 20850.

If the nonrefundable credit reduces a taxpayers liability to zero the taxpayer is eligible to claim a refundable credit equal to 26 of the federal credit in tax year 2016 minus any pre-credit state. If you earned less than 58000 in 2021 you may qualify for the federal Earned Income Tax Credit EITC. Nonresidents who work in.

Currently the law requires that in order to claim the WFIS tax credit a resident must be eligible and qualify for both the federal and state earned income tax credit. It is important to. The maximum federal EITC is 6728.

Montgomery County Code Chapter. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit.

This is available for the 2021 tax year dependent on your adjusted gross income AGI. Eligibility and credit amount depends on your. If you qualify for the federal earned income tax credit and claim it on your federal.

Providing a local earned income tax credit to Montgomery County residents will enable approximately 13600 households to receive an average refund of 330 with a. If you earn less than. It is a special program for low and moderate-income persons who have been employed in the last tax year.

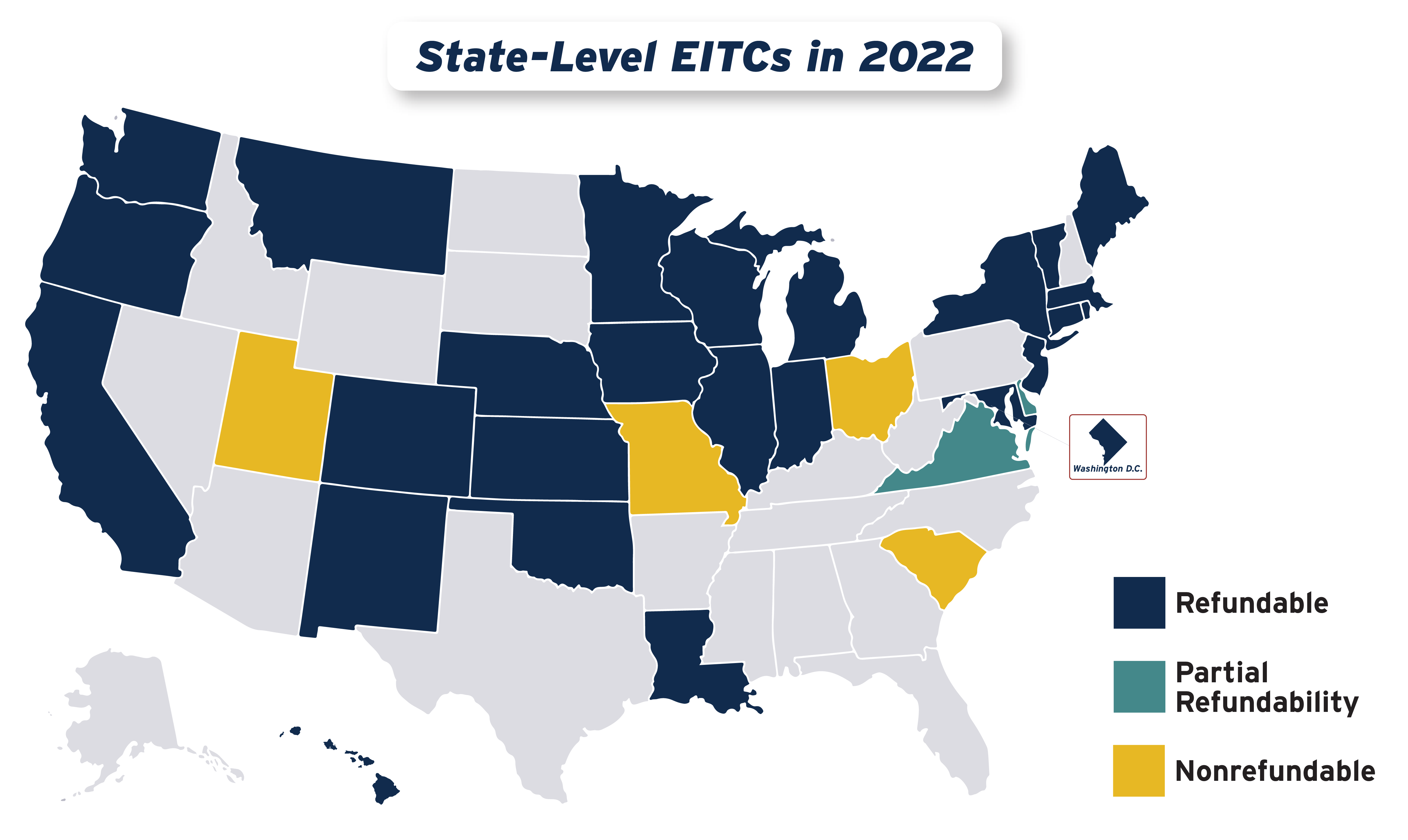

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

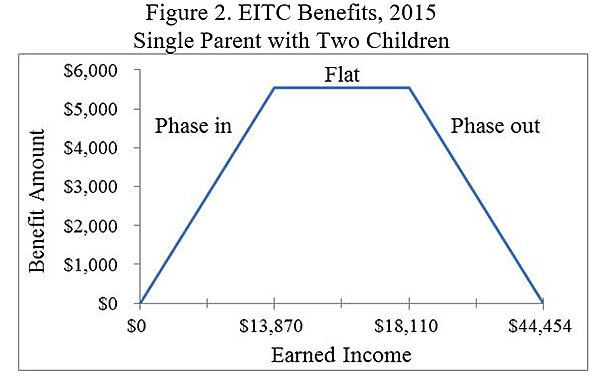

Earned Income Tax Credit Small Benefits Large Costs Cato Institute

Community Action Agency E News January 2022

Child Tax Credit Health And Human Services Montgomery County

Community Action Agency E News January 2022

Court Md Has Been Double Taxing Those Who Earn Income In Other States The Washington Post

Montgomery County Volunteer Income Tax Assistance Program Vita

Earned Income Tax Credit Small Benefits Large Costs Cato Institute

Child Tax Credit Health And Human Services Montgomery County

Earned Income Tax Credit Small Benefits Large Costs Cato Institute

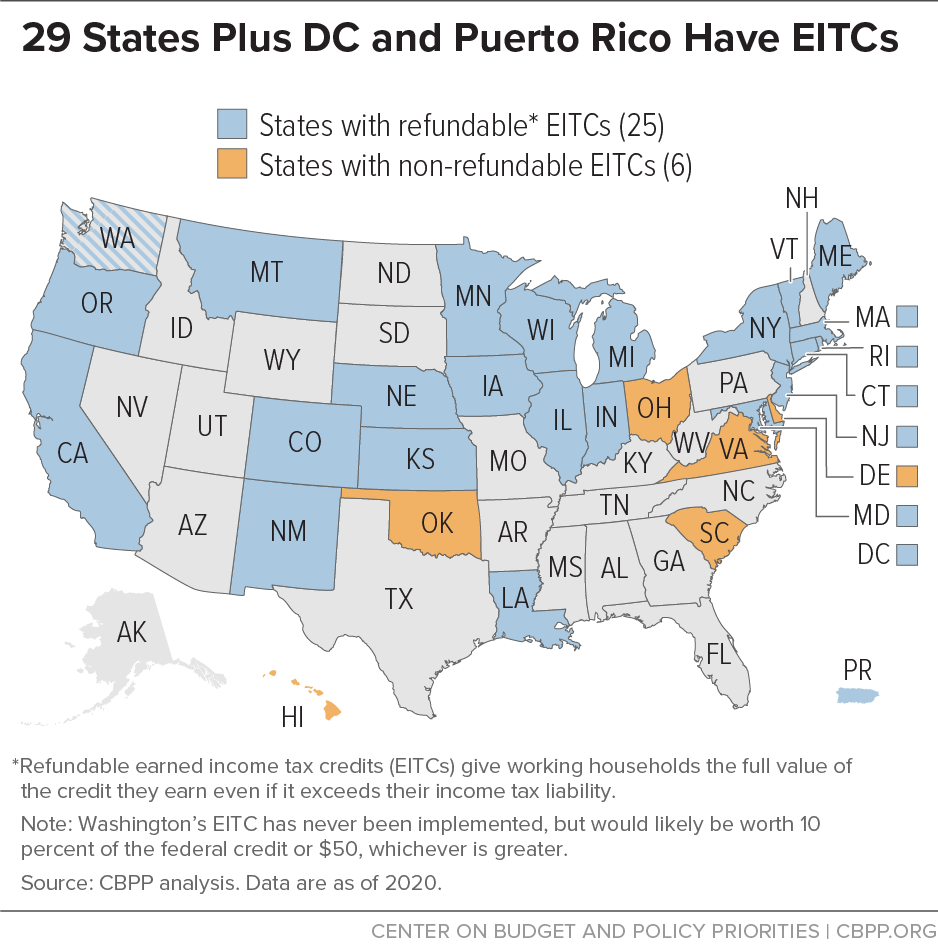

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

Some Montgomery Co Residents May Get Refunds After State Mistake Wusa9 Com

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

States Boost Earned Income Tax Credits For Pandemic Relief

Earned Income Tax Credit Small Benefits Large Costs Downsizing The Federal Government

Child Tax Credit Health And Human Services Montgomery County